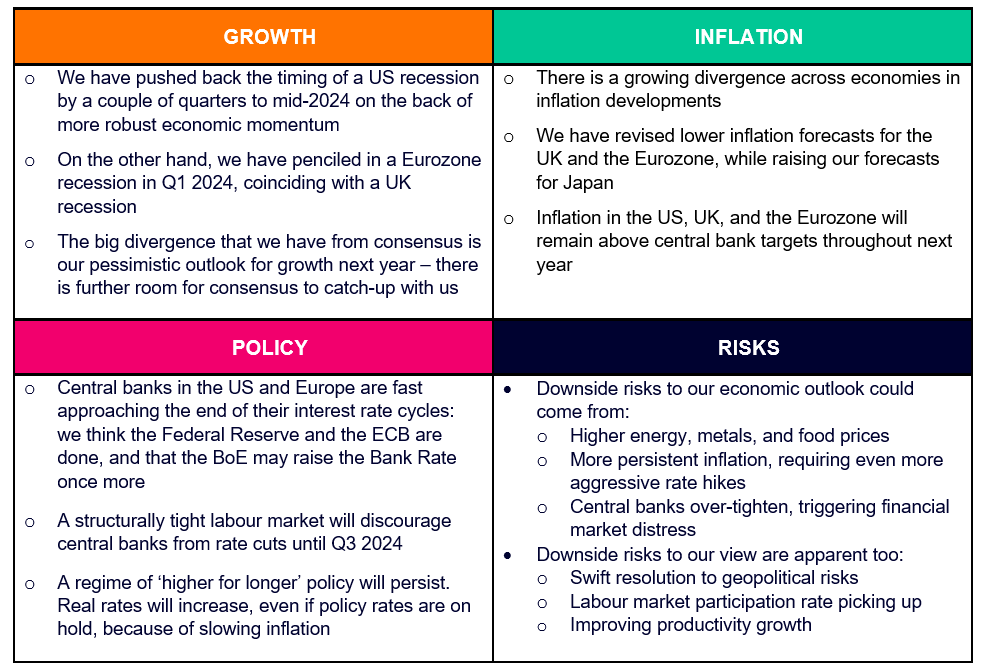

Growing divergences across economies: US recession delayed, European recession brought forward

25th October

Summarising this month’s investment view, Shweta Singh, Chief Economist, and Ross Barr, Senior Investment Strategist, commented: “Recently, equity markets have been paring back their year-to-date gains but, we think there is a short-term window where positive market performance from equities can resume before growth slows more meaningfully.

“Looking further ahead, corporate earnings are likely to weaken – the overall picture suits a cautious approach to investing in the asset class while we continue through late cycle conditions.

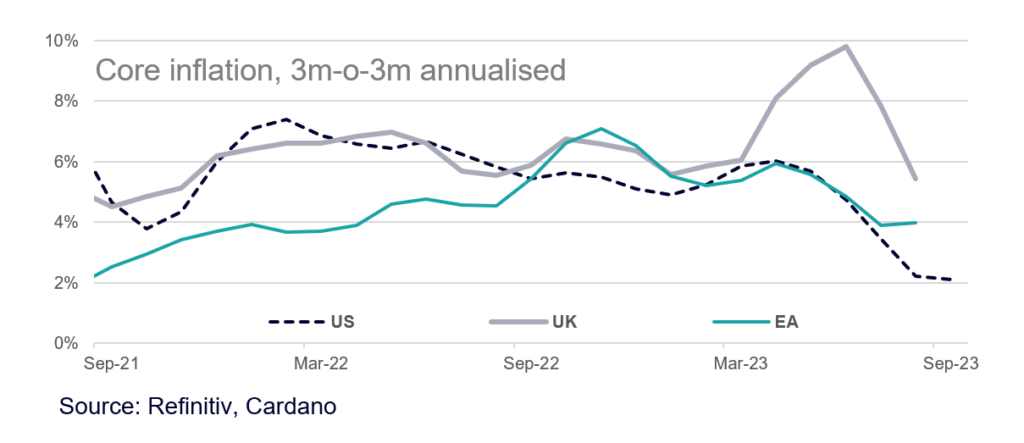

“Inflationary pressures continue to ease and while the path to 2% is going to be bumpy and long, the path ultimately is towards disinflation, rather than an acceleration in underlying inflationary pressures. However, energy prices are a wildcard card at the moment being propelled higher by the growing tensions in the Middle East and the risk of supply disruption.

“It is the effect of energy prices upon headline rates of inflation that strengthens our expectation that developed market central banks will keep the policy stance tight for a long period of time.

“In bond markets the outlook is more mixed. Interest rate cycles are mature, and growth is slowing, but inflation remains sticky. However, pricing for shorter maturity government bonds is now closely reflective of our own central bank outlook. We are beginning to turn more positive on the return expectations for government bonds as a result.”

Core themes

Spotlight – UK economic conditions worse than the headline numbers

While we are generally leaving our forecasts for growth next year unchanged (December 2024 GDP Growth +0.5% seasonally adjusted annual rate / Core Inflation +2.7% y-o-y) we have revised up our expectations for this year to capture the higher than expected level of activity through Q2. However, the underlying details of that Q2 boost show that fiscal spending has been a driver. Domestic demand has slowed sharply and the labour market is weakening swiftly.

Whilst the recent emergence of positive real wage growth may be supportive in the short-term we continue to look further ahead. We don’t envisage a strong boost to household consumption as many struggle to recoup their cumulative loss of real income over the past two years. The prevalence of relatively short term fixed-rate mortgages in the UK (as compared to the US, for example) will also likely constrain household consumption as more and more mortgages are refinanced at today’s higher rates.

Support from the corporate sector is also unlikely in our view. Most forward-looking indicators are pointing towards retrenchment with subdued hiring and curtailed capex expansion plans. We don’t see the catalysts on the horizon for this dynamic to change either.

Chart of the month: Core Inflation edging lower with the UK showing some large downside surprises over the summer