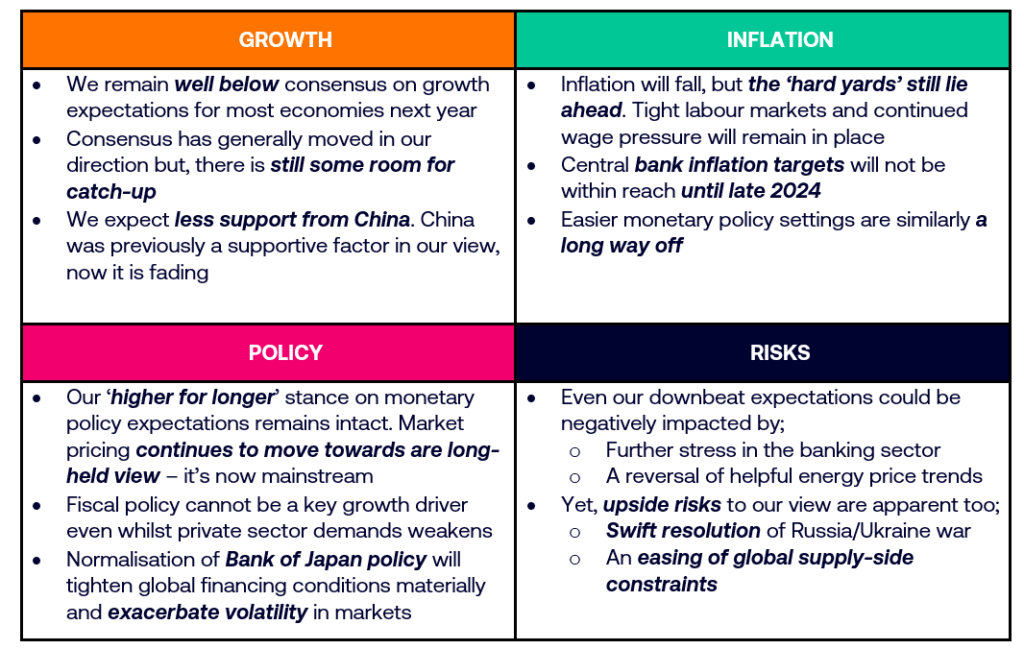

Slowing growth and persistent inflationary pressures paint a bleak picture for H2 2023

Summarising this month’s investment view, Shweta Singh, Chief Economist at Cardano, commented: “In revising lower our expectations for post COVID reopening growth in China we are giving less credence to one of the few supportive factors for global economic conditions in the near term.”

“Growth is set to slow. The persistence of elevated inflation, particularly with respect to core measures, confirms our long-standing view that central bank policies around the world are going to have to stay in restrictive territory for longer than the markets presently expect.”

Core themes

Spotlight – Bank of Japan monetary policy

The Bank of Japan (BOJ) maintained short-term interest rates and yield curve control policy in June, alleviating investors’ concerns. However, with inflation reaching levels not seen since the 1990s, the focus shifts to when, rather than if, policy adjustments will occur.

When interest rates eventually rise, bond yields will increase rapidly, posing challenges for the BOJ, which holds a substantial amount of government bonds. Higher interest rates could strain Japan’s public debt sustainability and impact fiscal plans.

While a rate increase may attract foreign investors and repatriate Japanese funds, it could harm exporters and hamper wage inflation, reigniting deflationary concerns. Additionally, if Japanese investors sell their foreign bond holdings, global bond markets could suffer significantly. The normalisation of Japanese policy will likely have far-reaching effects as the last major developed market central bank moves away from easy monetary policy. Therefore, the BOJ needs to carefully consider the implications of changing course, although resilient inflation may force their hand.

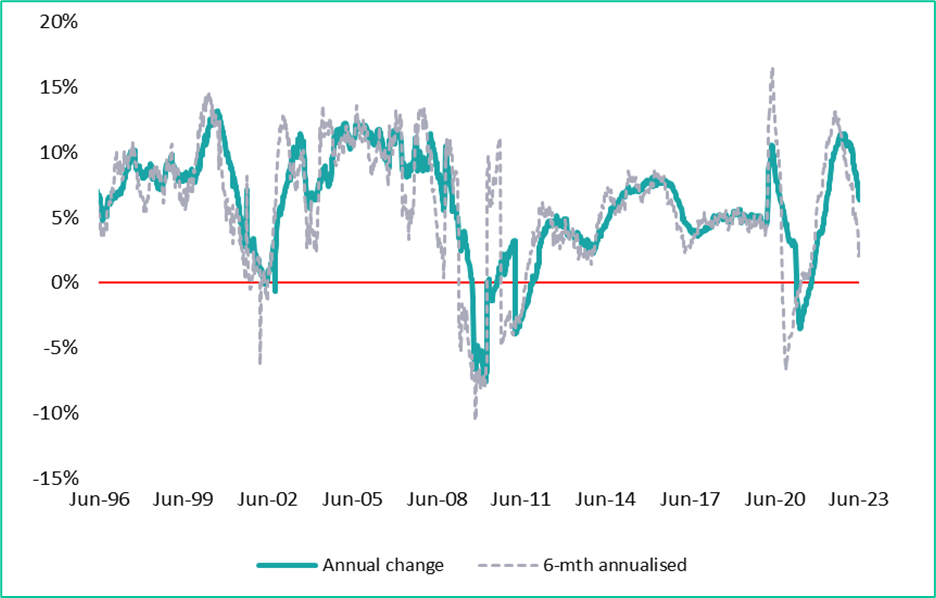

Chart of the month – Credit growth at US domestically-chartered banks is plunging

Source: Cardano, Datastream, Fed

Why is this important?

- US credit growth is rarely negative and is becoming a key factor to watch.

- Periods of contraction often coincide with serious disruptions within the US economy; dot-com bust, global financial crisis, COVID.

- US banks were tightening credit conditions at a rapid rate even before the regional banking sector stress, which has further exacerbated the bank lending conditions. Higher cost of funding and a poor growth outlook will damage credit creation further. External factors such as slowing global growth and a potential shift in the BOJ’s policy (see our notes on the BOJ above) will damage financial conditions even more.

- Deterioration in credit conditions will provide an additional headwind for US corporate earnings and equity market earnings multiples – a further threat to the US equity market