European Central Bank (ECB) joined the Fed in signalling rate hike cycle is nearing end

Shweta Singh, Chief Economist at Cardano, shared her thoughts on the ECB Governing Council (GC)’s decision on 27th July to raise the three key policy rates by 25bps.

The European Central Bank (ECB) joined the Fed in signalling that the rate hike cycle is nearing an end.

As was widely expected, the ECB Governing Council (GC) decided to raise the three key policy rates by 25bps today. The deposit facility rate now stands at 375%, a 425bps increase since the tightening cycle started in July 2022. President Lagarde said September is a ‘decisive maybe’ and unlike in the June meeting, when the ECB was not even thinking of a pause, it is very much on the table now. The key now therefore is not how high is the terminal rate, but for how long central banks maintain the tight policy stance.

The central bank acknowledged again that inflation continues to decline but is still expected to remain too high for too long. The economy is likely to remain weak in the near-term, but strengthen beyond that, improving real income and easing supply chain pressures. However, we think a rebound in economic growth is unlikely with weakening investment demand, and as the lagged effect of monetary policy tightening is felt more acutely, businesses will increasingly restrict capex and hiring plans, weighing on overall economic activity.

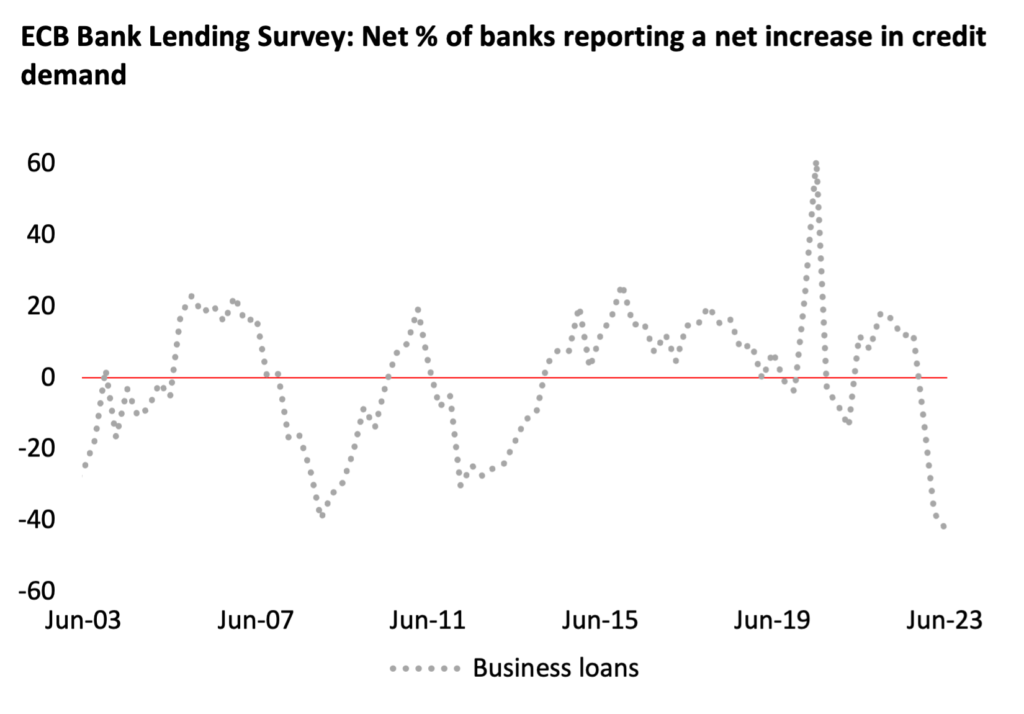

The ECB’s latest Bank Lending Survey released yesterday showed the sharpest drop in demand for loans by firms since such data became available in 2003. A weaker external backdrop will also weigh on economic momentum at a time when fiscal policy support is becoming less generous. Wage rises remain a key driver of inflation, but the risks of second round effects have eased due to slowing inflation and pressure on profit margins.

If the ECB decides to pause in September, the July’s hike would likely be the last in this cycle. Data by then would have shown further economic weakness, and there would be further evidence of disinflation. Our base case is that the central bank hikes by another 25bps in September and maintains a long pause after that, keeping real rates restrictive.