Bank of England raise interest rates to 5.25%

Shweta Singh, Chief Economist at Cardano, shares her thoughts on the Bank of England’s decision today to raise interest rates to 5.25%

“The Bank of England (BOE) voted 6-3 to raise the policy rate by 25bps to 5.25% in one of the most divided decisions since the tightening cycle began in December 2021. The decision is in line with our consensus and expectations, although marginally below market expectations. The BOE noted for the first time in this tightening cycle that the current monetary policy stance is restrictive. It also added that the Monetary Policy Committee will ensure that policy is sufficiently restrictive for long enough to return inflation to the 2% target, something we have been highlighting for some time now. There was no change in forward guidance: the Committee will remain evidence-based and “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required”.

The step down from the 50bps rate increase in the June meeting comes on the back of mixed data. On one hand, PMIs have slowed and consumer confidence has pulled back. A greater number of contacts of the Bank’s Agents had reported a slowing in the outlook for activity in the most recent period. There were also some signs that the labour market was loosening. In addition, twelve-month CPI inflation had eased to 7.9% in June, in line with the projection in the May Report. However, the labour market remained tight in absolute terms. Annual private sector regular pay growth had increased further in May, and was materially stronger than had been expected in the May Report. Moreover, both core goods and services CPI inflation had been stronger than expected at the time of the May Report.

Separately, the Bank released its updated economic projections, taking into account a much higher market-implied path for the policy rate: the peak Bank Rate that the BOE has conditioned its forecasts on is just over 6% and averages just under 5½% over the three-year forecast period compared with an average of just over 4% for the equivalent period at the time of the May Report. Consequently, relative to the May projection, quarterly GDP growth is expected to be weaker throughout much of the forecast period and the unemployment rate higher. Meanwhile, CPI inflation is projected to be higher in the medium term than in May and is expected to return to the 2% target less rapidly in the middle of the forecast period, reflecting the persistence of inflation in wages and domestic prices. Risks around the modal inflation forecast are still skewed to the upside, albeit by less than in May. This reflects that the second-round effects of external cost shocks on inflation in wages and domestic prices take longer to unwind than they did to emerge.

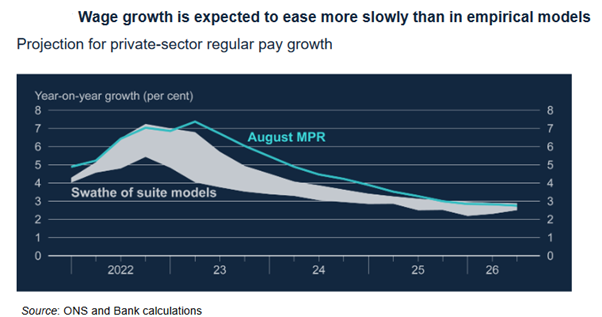

The key message from today’s monetary policy decision, monetary policy report, and the press conference can be summed up in the chart below: it shows that the Committee’s projection for private sector regular pay growth is higher than the upper bound of the range predicted by traditional economics wage models that take into account productivity, short-term inflation expectations economic slack. Whilst wage growth is expected to come down, the pace of deceleration is slow. There is also tremendous uncertainty around the outlook and risks are skewed to the upside. We expect another 50bps of rate hikes this year and policy to stay on hold until H2 2024. The BOE will have to stay more restrictive for an extended period of time.”