UK corporates risk falling behind on ESG and pension progress

19th December

- CFOs lack clarity on financial implications of ESG issues for their company

- CFOs remain unprepared for incoming climate-related regulatory requirements

- Only 37% of CFOs report alignment between corporate strategy and their pension scheme’s ESG agendas

- Majority of CFOs back equal accountability for pension trustee boards and corporate boards on EDI issues

CFOs of UK businesses remain unclear and unprepared for the potential impacts of environmental, social and governance (ESG) risks on their businesses, according to research from Cardano, the investment management and advisory business. This is despite the growing importance of ESG issues for companies of all sizes.

The findings come from Cardano’s report, New world, new decisions, which examines the views of over 220 UK CFOs and senior executives with responsibility for their company’s DB pension scheme.

CFOs lack clarity on the key financial and regulatory impacts of climate change

Cardano’s research highlights that many CFOs responsible for DB schemes are in the dark about the future financial implications of ESG issues on their businesses.

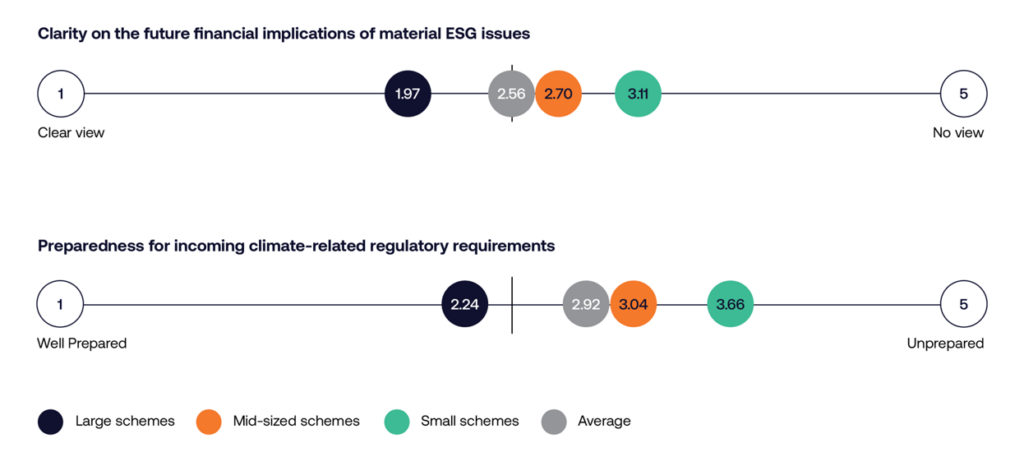

The average CFO only has a moderately clear view of the future financial implications of the most material ESG issues on their company, including existing climate change commitments. On a 1-5 scale where one represents ‘a strong view’ and five represents ‘no view’, CFOs rated their clarity at 2.56.

Similarly, CFOs are uncertain about their preparations for managing incoming climate related regulatory requirements. Only CFOs with large pension schemes rated their preparations above moderate (2.24) on a scale of 1-5, while the average CFO with a small scheme is under-prepared (3.66).

Graph 1: CFO assessments of financial and regulatory impacts of ESG and climate change

Michael Bushnell, Managing Director and Head of ESG Advisory UK, Cardano comments: “With many CFOs lacking clarity and therefore feeling unprepared to make meaningful progress on their ESG priorities, businesses must find new ways to develop a strategy that meets increasing regulatory requirements while maximising opportunities.

“While some businesses are taking steps to move forward, no-one can be comfortable with a situation where so many businesses are apparently in the dark about the financial implications of material ESG factors.”

Objective misalignment

Cardano’s findings also reveal wider misalignment between DB pension schemes and their corporate sponsors over ESG commitments.

Only 37% of CFOs and senior executives report that their corporate strategy and scheme ESG agendas are aligned. This includes just 15% who feel there is close alignment.

In contrast, 62% of CFOs think that their pension schemes have ESG agendas which are significantly different from their corporate strategy. This was particularly true among CFOs with small schemes (up to £100 million of assets under management), with 80% falling into this category. However, almost half (46%) of CFOs with large schemes (£1 billion+ AUM) said their corporate ESG strategy and pension scheme ESG agenda are significantly different.

The report shows the largest DB schemes have the strongest ESG alignment with their corporate sponsor, with 21% of CFOs stating that alignment is ‘close’ and 33% reporting it is ‘moderate’. Almost two in five CFOs (39%) responsible for large schemes are working with scheme trustees to align their ESG and corporate strategies.

This is in stark contrast to the outlook among small schemes, where 51% of CFOs report that addressing significant differences in ESG strategy is not a corporate priority. One in five (20%) CFOs responsible for mid-sized schemes (£100 million – £1 billion) feel the same.

Table 1: How closely aligned is your scheme’s ESG agenda to that of your corporate agenda?

| DB Scheme AUM | £50-100m | £100m-£1bn | £1bn plus | Total |

| Closely aligned | 8% | 13% | 21% | 15% |

| Moderately aligned | 10% | 22% | 33% | 23% |

| Significantly different and working with scheme trustees to align them | 29% | 45% | 39% | 39% |

| Significantly different but aligning them is not a corporate priority | 51% | 20% | 7% | 23% |

| Other/unsure/no view | 2% | 1% | – | 0% |

While the findings show schemes are divided on the importance of ESG alignment, there is clear consensus on the importance of accountability for Equality, Diversity, and Inclusion (EDI) issues. Four in five CFOs (80%) believe pension scheme trustee boards should be held to the same level of accountability as corporate boards, with fewer than 5% opposing this view.

Michael Bushnell, Managing Director and Head of ESG Advisory UK, Cardano continues: “Despite growing discourse around ESG risks, the fact that corporate agendas and their DB pension schemes’ ESG priorities are at odds with one another risks creating a zero-sum game where business and schemes are pulling in opposite directions.

“This lack of alignment represents a material risk for CFOs, with potential for either party to undermine good intentions and progress if external stakeholders find sponsors and trustees are out of step or even contradicting each other.”

Our new 2023 CFO report

New world, new decisions

Our new report, New world, new decisions, reveals proprietary insights into key areas of interest to UK CFOs and senior executives on the challenges and opportunities for their Defined Benefit (DB) pension schemes. This comes at a time where improved funding positions and burgeoning pension surpluses has created a new set of dilemmas for corporates.