This Summer’s economic resilience looking more likely to be a late-cycle peak

20th September

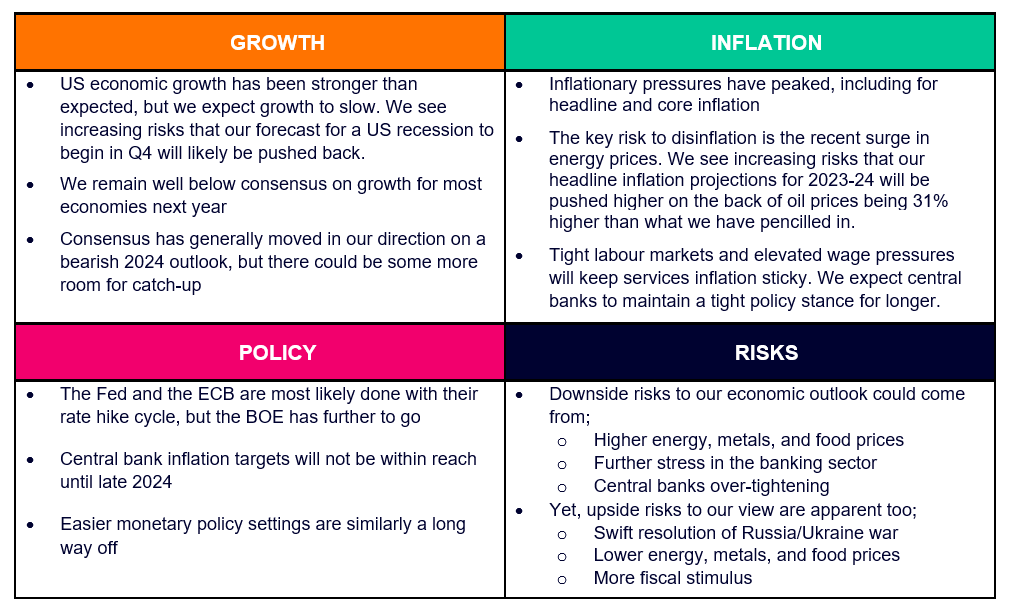

Summarising this month’s investment view, Shweta Singh, Chief Economist, and Ina Rinas, Senior Investment Strategist, commented: “Over the summer months, incoming data in the US has proven to be more resilient than most analysts, including us expected. But economic data in the Euro Area and China have dissapointed. Meanwhile, the better than expected run of Q2 data in the UK is giving way to a meaningfully slower pace of economic expansion.

“Monetary tightening feeds into the real economy with long and variable lags. Whilst we don’t know how long these lags are, there are reasons to believe that they have got longer on the back of policy and structural changes. But financial conditions have tightened meaningfully on a global basis as central banks embarked on one of the most aggressive tightening cycles in recent history. And, as a crucial leading indicator of activity, these constraints are bound to show up in real economic data in the future.

“Inflationary pressures are easing and whilst the path to 2% is going to be bumpy and long, the path is towards disinflation rather than an acceleration in underlying inflationary pressures. The key risk to this narrative is clearly higher energy prices: oil prices are 31% higher than what we pencilled in when we laid our economic forecasts in late June, challenging our projections to the upside.

“Higher energy prices strengthen our expectation that developed market central banks will keep the policy stance tight for a long period of time. Markets have generally moved towards our expectations over the last year, although higher oil prices could push central banks to stay hawkish for longer. We expect the Federal Reserve, and the Bank of Japan to make no change to policy this week, but we expect a 25bps rate hike from the Bank of England. Separately, many emerging market central banks have been cutting interest rates this year, including the People’s Bank of China (PBOC), the Banco Central do Brasil, and the National Bank of Poland. Whilst we expect the PBOC to ease monetary policy further, we are sceptical about the passthrough of these easing measures on the real economy.”

Core themes

Spotlight – Emerging Market Debt

We held a constructive view on Emerging Market (EM) Debt – particularly in local currency terms – and have been pleased with the strong performance year-to-date. The attractive yield on the asset class, and our expectation that some EM central banks will be able to start cutting rates earlier than developed market central banks as they have been more aggressive in their hiking campaign, has played out and has helped generate carry in excess of cash this year.

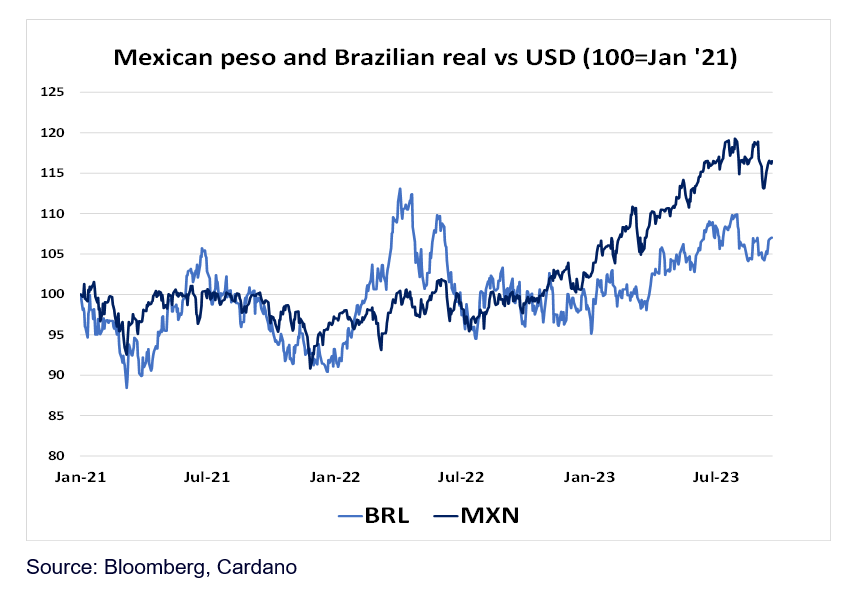

EM FX has also seen strong returns since the trough last year, as the US Dollar peaked and high yielding EM currencies – led by LatAm – have seen inflows on the back of better domestic inflation news. While we still think that carry in EM local is attractive and see more EM central banks cutting ahead, the outlook for EM FX is becoming more challenging. On the one hand, US growth is proving more resilient than in other regions, which helps the US Dollar, but on the other hand more dovish EM central banks have started to erode the interest rate differential, making them increasingly less attractive to foreign investors.

Chart of the month – Mexican peso and Brazilian real vs US dollar in the post-COVD period