Slowing growth, rapidly deteriorating financial conditions, but still sticky inflation

Latest macroeconomic investment thoughts from our multi-asset team

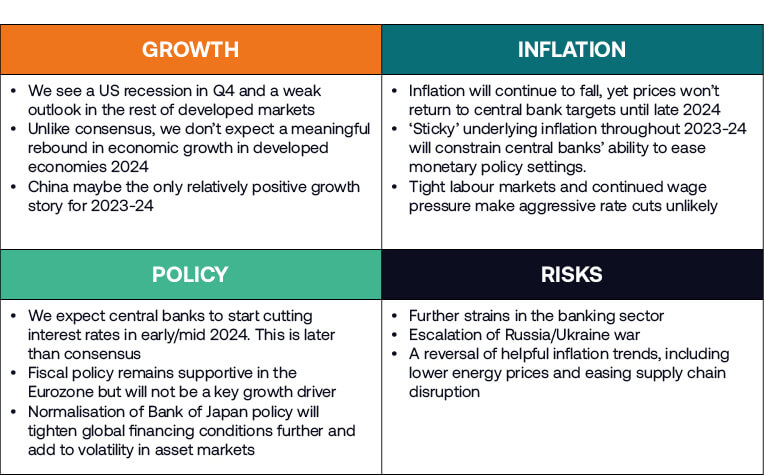

Summarising this month’s investment view, Shweta Singh, Chief Economist at Cardano, said: “Global economic growth will deteriorate throughout 2023 and will show only some modest improvement in the second half of 2024. The lagged effect of one of the most aggressive tightening cycles in developed economies in recent history will continue to weigh on global liquidity, financing conditions, and economic growth.

“The US will stagnate in Q3 and enter a recession in Q4. While a recession may now be avoided in Europe and the UK, economic conditions will remain lacklustre, at best. We think that consensus expectations for a swift rebound in activity next year are too optimistic. We don’t believe our economic outlook is fully priced. Equity market valuations are too high; both earnings and multiples are vulnerable.”

Core themes

Asset class spotlight – Emerging Market equities

Despite being cautiously allocated to global equity markets overall, we are constructive on Emerging Markets, because:

- The relative value between Emerging Markets and Developed Markets equities has fallen towards levels last seen at the turn of the century

- Emerging Markets have already experienced their “earnings recession while developed markets haven’t discounted the sharp slowdown/recession that we expect”.

- China and more broadly China-centric Emerging Markets are positively aligned to a post zero-COVID reopening growth dynamic

Even so, risks are rising from a slower than expected boost to Chinese growth from the end of Zero Covid Policy. Meanwhile, slowing economic growth in developed economies would also begin to weigh more heavily on Emerging Markets.

Chart of the month – US earning growth (YoY%)

Source: Cardano, Refinitiv Datastream/IBES

US earnings growth is still positive but has been on a downward trajectory over the past year, although it is still positive.

Why is this important?

- Recovery in Europe has surpassed depressed expectations and the rapid re-opening of China has boosted Emerging Markets’ assets. There are fundamental underpinnings of the performance of these regions

- In the US, whilst earnings have been resilient so far, equity market valuations do not discount the impending slowdown to the same extent as has been evident in bond markets

- A deterioration in earnings and earnings multiple is a double threat to the US equity market